Staying competitive requires not only innovation but also efficiency. Marketing automation platforms have emerged as essential tools for fintech companies looking to streamline operations, enhance client relationships, and leverage data-driven insights, and the true potential of these platforms is realized when they seamlessly integrate with fintech-specific software systems, which provide a complete view of client data.

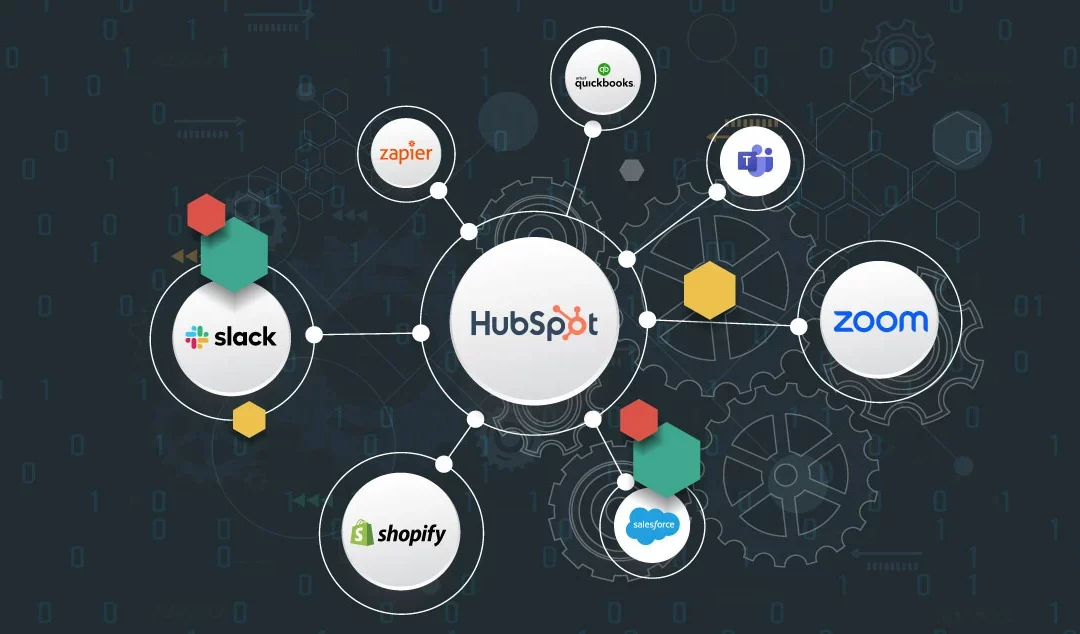

Integration is the key to unlocking the full potential of your software ecosystem and it involves connecting different software systems so that they work together. For fintech companies, this means integrating a marketing automation platform like HubSpot with other software tools used for client management, financial data analysis, and communication. This synergy reduces manual tasks, enhances data accuracy, and empowers data-driven decision-making. Some examples of what you can integrate with Hubspot are:

Customer Relationship Management (CRM) Systems: Fintech companies often rely on CRM software to manage client relationships and track financial interactions. HubSpot can integrate with leading CRM systems, ensuring that client data is synchronized across platforms. This integration provides fintech professionals with a centralized view of client interactions, transaction history, and engagement opportunities.

Financial Data Analysis Tools: Fintech thrives on data, and integration with data analysis tools is crucial. HubSpot can seamlessly connect with these platforms used for risk assessment, market trends analysis, and investment portfolio management, which empowers fintech professionals to access comprehensive financial insights within their marketing automation platform.

Payment Processing and FinTech APIs: Many fintech companies offer payment processing services or leverage external APIs for financial transactions. HubSpot’s integration capabilities extend to payment processing systems and fintech APIs. This enables automated tracking of payment history, subscription renewals, and transaction updates directly within HubSpot.

Email and Communication Tools: Effective communication is essential in fintech, and integrating HubSpot with email and communication tools ensures that client communications are logged, tracked, and analyzed within the marketing automation platform. This centralized communication history enhances client engagement and regulatory compliance.

Seamless integration between HubSpot and fintech software systems offers a holistic view of client data. This integration enhances efficiency by eliminating manual data entry and breaking down data silos. With a single platform providing access to client information, financial data, and communication history, operations are streamlined, productivity soars, and errors diminish. The result is an environment conducive to informed decision-making, where fintech professionals leverage comprehensive client data to identify investment opportunities, assess risk factors, and personalize client interactions. This personalization fosters trust, strengthens client relationships, and gives fintech companies a competitive edge.